As the amount of Internet traffic created around the world continues to grow, big data becomes an increasingly necessary part of business and companies continue to expand their IT infrastructure, the data center industry continues to grow but at a decelerated rate. Reports that there is more demand for data center services than there is supply is unlikely considering the amount of active development. Major providers have become more sophisticated managing their JIT development of space based on customer demand, and therefor deployment of capital to maintain optimum ROIC (return on invested capital).

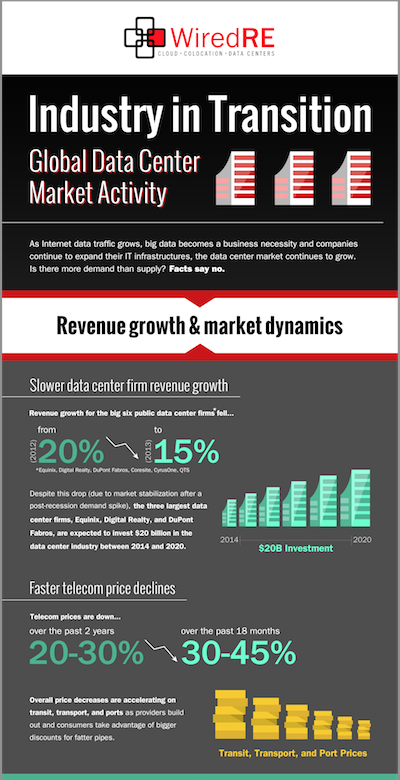

While revenue growth for the Big Six public data center firms (EQIX, DLR, DFT, COR, CONE, QTS) fell between 2012 and 2013, it still maintained a respectable year-over-year growth of 15 percent. At of the end of Q2 2014 the revenue growth trajectory remains at a stable pace. The top three data center providers in the market are expected to increase investment in data center expansion by more than $20 billion by 2020. Telecom prices have decreased in recent years, dropping between 20 and 30 percent in the last two years and as much as 30 and 45 percent for some high volume services. As the cost of service goes down, utilization increases and encourages investment in the fiber network and data center market.

Over the next four years the global data center market is expected to grow 22 percent annually. Physical space in the U.K. devoted to data centers increased 18 percent in 2013 and expansion is also on the rise in Latin America, with a projected sector growth of 27 percent annually between 2015 and 2018.

At the same time, the global colocation market is projected to increase $15 billion between 2013 and 2018. In Canada and the U.S., data center colocation grew by 13 percent last year and is expected to grow another 11 percent each year until 2019. The worldwide market for cloud computing has been the main driver of data center use, increasing 126 percent in just the last year. The Asia Pacific region is showing the largest amount of growth in cloud computing, with spending rising $3 billion over three years.

Global Data Center Market Activity Infographic