CyrusOne (NASDAQ: CONE) isn’t exactly a new kid on the block, but with their January IPO and the added twist of being approved as a REIT, they will surely be noticed now. In an industry dominated by telecom and Internet related companies, CyrusOne seems to have found a good niche serving the enterprise market.

Overview

CyrusOne rooted itself in the data center business in 2001 as a part of Cincinnati Bell, called Cincinnati Bell Technology Solutions, Inc. They subsequently acquired GramTel in 2007 for $20 million, and Cyrus Networks in June 2010 for $526 million. The amalgamation of these assets has created CyrusOne LP, which is headquartered in Carrollton, Texas.

As of Q2 2013, the firm has 1.9 million gross square feet with 970,000 square feet of colocation space at 25 data center locations in Ohio, Texas, Arizona, Illinois, Indiana, the U.K. and Singapore. CyrusOne reported 248 MW of utility power and we estimate critical load for all facilities at approximately 130 to 140 MW. They also have 806,000 square feet of powered shell space, allowing them the opportunity to almost double their colocation footprint as the need arises.

Customer Mix

The CyrusOne customer targeting strategy is referred to internally as “converting the unconverted,” as Gary Wojtaszek, President and CEO of CyrusOne, described at the NAREIT convention in Chicago, June 2013. Their clearly stated goal is to become the preferred global data center provider to the Fortune 1000. This also includes organizations in the same size category that may be private or international. Their focus, said Wojtaszek, is “attracting customers that have not historically outsourced.”

This would seem a tall order considering that success for most colocation companies is mostly outside this scope. Digital Realty Trust quotes an enterprise customer base of 37 percent, Coresite 11 percent, and the most recent data from Dupont Fabros suggests under 30 percent of their client roster includes enterprise companies (Dupont stopped disclosing tenant diversification detail in their SEC filings in 2010).

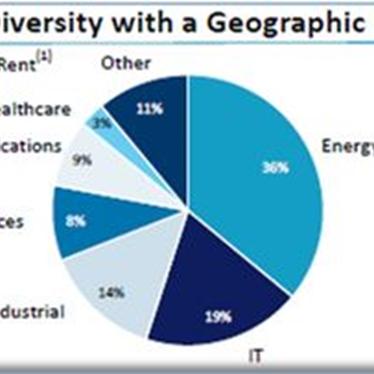

Wojtaszek says 80 percent of their revenue comes from enterprise markets. The chart, from the NAREIT presentation, shows detail on their customer mix. The “other” category is a mystery, but even if it proved to be Internet-centric businesses that would still illustrate that their focus is on the enterprise sector. One third of their client base is in the oil and gas sector, a very substantial market in their home territory of Texas.

Converting the unconverted is a process of education and building trust over time. In fact, the sales cycle can be two to three years to build enough confidence and trust. Once a client decides to make the move to a CyrusOne facility they typically start small, but the strategy has worked as CyrusOne now books 60 percent to 70 percent of their new revenue through existing customers as they expand.

One of the key factors for converting the unconverted is the list of referenceable brand name clients. There’s never been a debate about the sales value of referenceable clients, and the fact that five out of the six top oil and gas companies are clients is beneficial for that sector and the geography as well. Convincing an enterprise to outsource their critical assets does not come easy, especially considering many enterprises have been internally managing their own IT for decades. The economics of building cost-effective data centers have changed dramatically in recent years, and it is not always in an enterprise’s best interest to build or maintain their own facility and infrastructure.

Flexibility and customer service are big contributors. CyrusOne offers a diverse set of services, as would be expected from a hybrid retail/wholesale provider. Their customer split is just about 50/50 between wholesale and retail.

Wholesale vs Retail Product Mix

According to annualized rent figures unveiled at CyrusOne’s 2Q 2013 earnings presentation, 53 percent of their customers are wholesale (metered power), while 47 percent are retail (full service customers).

The difference, according to Wojtaszek, is how they strive to deliver exactly what each individual client needs for their applications. The same amount of space on the same data center floor could be rather different in pricing depending on the needs of that client. If less than five nines is acceptable for a non mission critical applications, that can be built into the equation. Customer churn for recent quarters has been respectably low. After coming in at 1.8 percent in 2Q 2012, churn dropped for three consecutive quarters, from 1.5 percent (3Q 2012) to 0.6 percent (4Q 2012) to 0.4 percent (1Q 2013). It rose slightly in 2Q 2013, to 1.2 percent. Aggregate 12 month churn through 2Q 2013 was 3.7 percent. Note: Recurring Rent Quarterly Churn is defined as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of annualized rent at the the beginning of the quarter, excluding any impact from metered power reimbursements.

CyrusOne Profile

As a recent IPO, there isn’t a great amount of historic financial detail available for the new entity.

CyrusOne Revenue Profile ($ in millions)

| 2012 | 2011 | 2010 | |

| Revenue | $220.8 | $187.7 | $128 |

| Percent Growth | 15 percent | 31 percent | |

| Net Income* | ($20.3) | $1.5 | N/A |

| Adj. EBITDA | $155 | $100 | $66 |

* Loses attributed to IPO costs.

For Q2 2013 revenue was $63.6 million, an increase of $9.6 million, compared to $54 million for the corresponding quarter in 2012.

CyrusOne Profile 12/31/2012

| Founded | 2001 |

| WW Employee Total | 250 |

| Facilities | 25 |

| Gross Square Feet | 1.7 million ft2 |

| Net Sellable Data Center Space | 920,000 ft2 |

| Clients | 527 customers – 426 have < 1000 ft2 |

| Market Coverage | 10 markets, 3 countries |

| IPO Date | January 18, 2013 |

| Market Cap | $1.05 billion |

CyrusOne Expansion

Phase 1 of the new Phoenix facility was commissioned in December 2012 after just seven months of construction at a cost of $7 million per MW, according to CyrusOne. We toured the facility in May, 2013, which includes 190,000 square feet of total space. There are two 40,000 square foot data halls and 90,000 square feet of office space. One of the data rooms is open for business with 30 percent occupancy at the time. At complete build-out the facility could be 1 million square feet.

In 2010, total colocation space available amounted to 639,000 square feet, with 563,000 square feet (88 percent) utilized. In 2011 total available area increased to 763,000 square feet, with 673,000 square feet (88 percent) occupied. Total area rose again in 2012, to 932,000 square feet, with 730,000 square feet (78 percent) occupied before dipping slightly to 921,000 square feet as of this March 31. However, 747,000 square feet (81 percent) of that space was utilized. Overall, colocation space experienced an 18 percent compound annual growth rate over the period.

It is also interesting to note that CyrusOne has expanded their sales force to 34 from 19 representatives in the last 12 months. It’s common for new sales staff to take nine to 12 month to realize full sales potential, which was reflected in the 2Q 2013 earnings presentation.

Finally, as part of their overall market strategy, the CyrusOne National IX data center interconnectivity program was launched on April 1, 2013, after 18 months of planning and development. The strategy has already seen results with 68 percent of new leases participating. This move is important as the enterprise market they focus on is typically made up of organizations with multiple data centers. Part of convincing enterprises to embrace a colocation outsourcing strategy is the ability to support data replication and disaster recovery strategies with an internal interconnection infrastructure.

Stay Tuned

CyrusOne will be interesting to keep an eye on in the future. The amount of dollars tied up in data center real estate for the enterprise market is significant, and the evolution of the enterprise market embracing the colocation model as a way of managing CapEx and utilizing modern facilities may well be reflected by CyrusOne’s success as they continue to nurture this market.

This report is for informational purposes only and should not be construed as investment advice. Seek an appropriate professional for investment advice. Financial data sourced from SEC filings. For questions about this report contact Alan Howard at ahoward (at) wiredre.com or 602-885-5311.